EOG Resources exceeds profit expectations for the fourth quarter on higher production

EOG Resources surpassed fourth-quarter profit expectations on Thursday as higher production helped offset lower oil price. The company's shares were down 3.5% in after-hours trading as the net income fell by more than half, to $1.25 Billion from $1.998 Billion the previous quarter. The overall quarterly revenue dropped 12%, to $5.59 Billion. This was due to lower oil revenues as well as losses on derivative contracts.

US natural gas drillers will increase output in 2025, reversing a year-long cut

The U.S. Natural Gas producers will increase output in 2025 after a series production cuts this past year. Rising demand from LNG export plants should raise prices, which had dropped to multi-decade lows. According to the latest U.S. Energy Information Administration outlook, U.S. natural gas production will decline in 2024, for the first drop since 2020 when the COVID epidemic reduced demand.

EOG Resources to boost shareholder returns

EOG Resources announced on Friday that its debt levels would allow the oil and natural gas producer to use more than 100% free cash flow for shareholder returns. In afternoon trading, shares of the company rose by 4.8% to $132.54. The company announced that it would increase its debt to between $5 and $6 billion over the next 12-18 months. This would allow for additional cash to be available to pay out to investors.

EOG Resources beats Q3 profit estimates, boosts share buyback program

EOG Resources increased its share-repurchase program after beating Wall Street expectations for the third-quarter profits, due to higher production and lower prices. The U.S. Energy Information Administration reported that total oil consumption in the United States rose to its highest level for the season since 2019. In July, the gasoline demand also reached its highest levels for the season since 2019.

EOG will increase activity in the Utica shale in Ohio, says company

Jeff Leitzell, chief operating officer of Houston-based EOG Resources, told the Barclays CEO Energy-Power Conference attendees in New York that the company expects to increase operations in the Utica Shale play in Ohio. Leitzell stated that EOG Resources had doubled its Utica activity year-on-year. The company now operates on 445,000 acres at an average cost of $600 per acre.

US Drillers Add Oil and Gas Rigs for Fifth Week in Six

U.S. energy firms this week added oil and natural gas rigs for the fifth time in six weeks although growth in the rig count over the past few months has slowed as drillers continue to focus on capital discipline despite firmer oil prices.The oil and gas rig count, an early indicator of future output, rose three to 491 in the week to Aug. 6…

Investors Brace for Poor US Shale Earnings

Investors are bracing for weaker results from U.S. shale players in coming days as lower oil and natural gas prices and cost-cutting measures have weighed on third-quarter operations.Major shale producers ConocoPhillips and Concho Resources this week kick off quarterly earnings reports for a group whipsawed this year by volatile pricing and investor demands for improved returns.

Tailwind Completes EOG UK Acquisition

London-based Tailwind Energy has announced the completion of the acquisition of Houston-headquartered oil and gas firm EOG Resources's UK portfolio. The oil and gas venture announced two months ago it has agreed with EOG Resources Inc to acquire EOG’s UK business, subject to regulatory approvals. As part of the inherited EOG UK portfolio…

EOG Resources Tops Profit Eestimates

EOG Resources on Thursday topped Wall Street's third-quarter profit and revenue estimates on record oil production, and raised its spending outlook for the full year.Spurred by higher crude prices and advances in hydraulic fracturing, U.S. producers have hit records nearly every month this year. In August, the country's oil production hit a record 11.35 million barrels per day (bpd).Houston-based EOG produced 415…

Shale Innovator Mark Papa Joins Schlumberger Board

Oilfield services company Schlumberger NV has appointed shale pioneer Mark Papa and energy researcher Tatiana Mitrova to its board of directors, according to a filing on Monday with the U.S. Securities and Exchange Commission.Papa, who built independent energy producer EOG Resources into one of the most profitable U.S. shale companies, currently…

U.S. Drillers Add Rigs for 6th Consecutive Week -Baker Hughes

U.S. energy companies added oil rigs for a sixth week in a row as crude prices hovered near three-year highs, prompting more drillers to boost their spending plans for 2018. Drillers added 1 oil rig in the week to March 2, bringing the total count to 800, the highest level since April 2015, General Electric Co's Baker Hughes energy services firm said in its closely followed report on Friday.

Apache's Latest Plan Shows U.S. Shale Boom Has Legs

Apache Corp Chief Executive John Christmann is betting the future of his company on a remote corner of the Permian Basin, the largest U.S. oilfield, planning to spend billions of dollars in the next 20 years to drill more than 5,000 wells. The development of the company's Alpine High field holds ramifications for U.S. oil reserves and future output from the already prolific Permian oilfield in Texas.

Pressured for Profit, Oil Majors Bet Big on Shale Technology

Shale oil engineer Oscar Portillo spends his days drilling as many as five wells at once - without ever setting foot on a rig. Part of a team working to cut the cost of drilling a new shale well by a third, Portillo works from a Royal Dutch Shell Plc office in suburban Houston, his eyes darting among 13 monitors flashing data on speed, temperature…

US Shale Producers Promise Higher Output and Returns

U.S. shale producers are telling investors impatient for better returns that they can keep boosting oil output aggressively and do so while still making money for shareholders. Investors have pushed top U.S. shale companies to focus on returns, rather than higher output, a move that threatened to slow the breakneck growth in supply sparked by the shale revolution in the world's top oil consumer.

US Gasoline Prices Climb as Refineries Gradually Restart

U.S. retail gasoline prices climbed Tuesday, even as oil refineries rumbled back into service after Hurricane Harvey disrupted operations along the Texas coast. The average gasoline price was $2.648, 30.2 cents higher than a month ago, according to motorist advocacy group AAA. Gasoline prices normally retreat after the U.S. Labor Day holiday weekend. Benchmark U.S.

US Drillers Add No Oil Rigs as Harvey Slows Production

U.S. energy firms did not add any oil rigs this week as Hurricane Harvey barrelled into the nation's energy heartland, forcing drillers to halt production and refiners to shut plants. The total oil rig count for the week ended Friday stayed at 759, General Electric Co's Baker Hughes energy services firm said in its report on Friday. That compares with 407 active oil rigs during the same week a year ago.

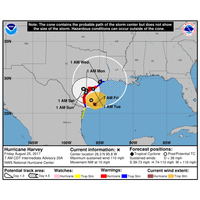

Residents Flee South Texas Ahead of Harvey

Residents fleeing most powerful storm on U.S. mainland since 2005. Businesses closed and lines of cars streamed out of coastal Texas as officials called for residents to evacuate ahead of Hurricane Harvey, expected to arrive about midnight as the most powerful storm to hit the U.S. mainland in more than a decade. The hurricane is forecast to slam first near Corpus Christi…

U.S. Drillers Cut Rigs ahead of Hurricane - Baker Hughes

U.S. energy firms cut oil rigs for a second week in a row ahead of Hurricane Harvey and as a more than year-long recovery in drilling slows down in reaction to soft crude prices. Drillers cut four oil rigs in the week to Aug. 25, bringing the total count down to 759, General Electric Co's Baker Hughes energy services firm said in its report on Friday. That compares with 406 active oil rigs during the same week a year ago.

Hurricane Harvey Strengthens, Threatens US

Hurricane Harvey intensified early on Friday into potentially the most powerful hurricane to hit the U.S. mainland in more than a decade, as authorities warned locals to shelter from what could be life-threatening winds and floods. Harvey is set to make landfall late Friday or early Saturday on the central Texas coast where Corpus Christi and Houston are home to some of the biggest U.S. refineries.

U.S. Shale Producers Drilling Themselves into a Hole

U.S. shale firms are drilling themselves into a deep hole despite warnings from industry leaders about the risk of flooding the market with too much crude, says Reuters analyst John Kemp. Drilling and production are rising. Prices are declining. Companies are barely breaking even or losing money. Costs are starting to rise. And share prices are sliding.