Bloomberg News reports that Abu Dhabi's ADNOC is considering a bid for Aethon US natgas assets.

Bloomberg News, citing sources familiar with the situation, reported Friday that Abu Dhabi's state oil company ADNOC was considering a bid to acquire natural gas assets from investment firm Aethon Energy Management, which could be worth up to $9 billion. ADNOC is acquiring a number of companies in the gas and chemical industries, which it sees as important pillars to its future growth. The energy giant purchased a stake and a supply contract for 20 years in NextDecade’s liquefied gas export project located in Texas. The report said that the US energy investment firm is still in the initial stages of its discussions and has not reached any final agreements.

Indonesia will maintain the monopoly of electricity by state utilities, says the president's assistant

A close advisor to Indonesian President Prabowo said that he has decided to not change the monopoly of the state-owned power utility on the electricity markets despite calls to liberalise the market to encourage investment in renewable energy. Hashim Djojohadikusumo is the brother of the president and his adviser. He said that despite some conglomerates' requests, Prabowo had decided to keep PLN as a monopoly. During the election campaign last year, a proposal to break the monopoly held by the state-run Perusahaan Listrik Negara was considered to speed up the adoption of renewables.

Norway's wealth funds continues to invest in renewables, despite the market downturn

A senior fund official stated on Thursday that Norway's $1.8 billion wealth fund, which is the largest in the world, will continue to invest in renewable assets, despite recent market downturns. The fund will also seek out opportunities both in the public and private markets. In 2024, renewable energy assets will have underperformed the market significantly. This includes some of the previous favourites among investors such as Danish offshore developer Orsted. The fund's investments in renewable energy infrastructure that is not listed, including stakes in Orsted's offshore wind farms and the renewables portfolio of Spanish utility Iberdrola…

Report shows that global energy investment exceeded $2 trillion last year.

BloombergNEF reported on Thursday that global investment in the low-carbon energy transformation exceeded $2 trillion last year for the first. Many experts believe that the pace of development is too slow. Countries all over the world are developing and investing in cleaner energy sources and infrastructure, but they still have not met the climate targets set by the Paris Agreement. To achieve a net-zero emissions target before the mid-century, global energy investment must average $5.6 trillion per year between 2025 and 2030. BloombergNEF’s…

Lazard hires Miller from Citigroup in its energy investment banking drive, sources claim

People familiar with the matter said that Lazard hired Citigroup veteran investment banker Chris Miller to lead its dealmaking efforts within the energy sector. Miller, who was based in Houston, and had the title of vice-chairman of energy investment banking for Citigroup, recently resigned his position with the Wall Street bank and will begin his new role at Lazard early in 2025, after a period gardening leave, according to the sources. The sources, who requested anonymity because the matter was confidential, said that Miller would report to George Bilicic. Bilicic is the head of Lazard’s power, infrastructure, energy and investment banking unit.

Industry says that the US dependence on Canadian oil should discourage Trump tariffs

Canada's oil industry doesn't expect tariffs to be included in the protectionist measures proposed by Donald Trump, U.S. president-elect. This is because U.S. refineries depend on Canadian barrels. Some Canadian oil industry players saw Trump's victory as a positive, which would encourage energy investment in North America. It could also boost the value of U.S. dollar that Canadian producers get for their crude. Some however, said that any increase in U.S. production of oil and gas could put Canadian exports into competition with other countries. Canada is the fourth largest oil producer in the world and the sixth largest natural gas producer.

Net zero target needs $3.5 trillion in annual green energy investment, Wood Mackenzie says

Wood Mackenzie's report on Tuesday said that the investment in green energy must double every year to $3.5 trillion if we are to reach the Paris Agreement goal of net zero emissions by the year 2050. The consultancy's report said that, in addition to the investment gap, global efforts to switch to cleaner energy are under pressure due to concerns about energy security and tariffs and barriers to trade, which are stunting the electrification of growth globally. According to the report, no major countries and only a handful of companies are on track to achieve the 2030 climate goals set forth in the Paris Agreement.

Southeast Asia must increase investments by five times to achieve climate goals by 2035, according to the IEA

International Energy Agency stated on Tuesday that Southeast Asia must increase its clean energy investment to $190 billion by 2035, or five times current levels, to achieve climate goals. The IEA stated in a recent report that increasing energy investments must be accompanied with strategies to reduce emissions at the relatively new fleet of coal-fired power plants. The report also stated that the rapid expansion of the economy would pose a challenge to energy security and climate change goals. The closure of coal power plants, supported by wealthy Western nations, in emerging markets is being delayed after the July deadline for a pilot project in Indonesia was not met.

TotalEnergies begins early production of Fenix gas in Argentina

TotalEnergies, a French oil company, said that natural gas production had begun earlier than expected at Argentina's Fenix off-shore field. The $700-million project was originally scheduled to start operating in November. It has a daily production capacity of 10,000,000 cubic meters of gas, which represents 8% of Argentina’s total production. Gas from the Fenix Field off Argentina's southern coast will be used for domestic consumption. Argentina is trying to reduce imports and deregulate prices locally, encourage energy investment, and become a LNG exporter.

The Indian unit of German lender KfW plans to double its investments to $1 billion

A top executive at the German state bank KfW said that the unit's investments in India will more than double to $1 billion within the next few year, with a particular focus on India's energy and Infrastructure projects. DEG, the unit of the lender that focuses on private sector companies, invested so far about $400 million into debt and equity in India. "India is a market that we consider to be very important because it offers a good investment climate, and has many strong entrepreneurs and developers who we are happy to support," stated Jochen von Froein, Director, Infrastructure & Energy, Global Equity at DEG.

Argentina's energy investments are expected to reach $15 billion next year due to deregulation

The Energy Secretary Eduardo Rodriguez Chirillo stated on Tuesday that Argentina expects to see investments in its energy sector reach $15 billion by 2025, and $16.5 billion by 2026 as a result of the market deregulation efforts. According to Rodriguez, the estimated expenditure includes additional funds flowing from the country's investment promotion regime RIGI, which Rodriguez estimates ranges from $2 billion to $25 billion per year. At an event hosted by Shell, Rodriguez said that the measures would lead to a more favorable business climate and attract investment. "We're at record production," Rodriguez said.

China and South Africa agree on balanced trade, increased investments

A joint statement released on Tuesday revealed that China and South Africa's top leaders, who met in Beijing, had agreed to promote a balanced trade, and also discussed the importance of boosting bilateral investments between their commercial and industrial communities. President Xi Jinping met with his South African counterpart Cyril Ramaphosa on Monday ahead of the ninth Forum on China-Africa Cooperation. Both sides described Ramaphosa’s visit as "of great significance" for the development of bilateral relationships. Ramaphosa and Xi had discussed the South African trade deficit with Beijing, and reviewed his country's trading structure with China.

China will continue to implement low-carbon reforms according to the energy regulator

The energy regulator in China said that China would continue to phase out fossil fuels, and reform its electricity system. It issued a paper on Thursday listing achievements, but lacking new plans for China’s energy transition. Zhang Jianhua, the head of China's National Energy Administration, said that China will continue to reform its electric system, expand the market for spot electricity, promote green electricity trade and replace fossil fuels by renewable energy. He also called on market-oriented reforms. Zhang, speaking at a State Council press conference, China's cabinet said that China had invested $676 billion last year in its energy transformation.

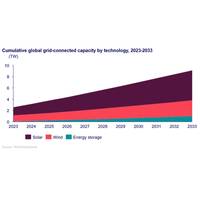

Solar, Wind Uptake to Reach 5.4 TWac from 2024 to 2033, Says Wood Mackenzie

Global solar deployment to add 3.8 TWac of new project capacity by 2033 compared to 1.6 TW of wind power, while 640% growth is forecast for energy storageFrom 2024 to 2033, developers will bring more than 5.4 terawatts (TWac) of new solar and wind capacity online, increasing the cumulative global total to 8 TWac, as the world endeavours to electrify economies and meet decarbonisation targets, according to latest analysis by Wood Mackenzie.Energy storage capacity (excluding pumped hydro) will grow by more than 600%, with nearly 1 TW of new capacity expected to come online in the same period.

Russia's Medvedev Says Oil Could Hit Up to $400 a Barrel if Japanese Proposal Adopted

Russia's former president Dmitry Medvedev said on Tuesday a reported proposal from Japan to cap the price of Russian oil at around half its current level would lead to significantly less oil on the market and could push prices above $300-$400 a barrel.Commenting on the proposal, which was reportedly put forward by Prime Minister Fumio Kishida, Medvedev said Japan "would have neither oil nor gas from Russia, as well as no participation in the Sakhalin-2 LNG project" as a result.President Vladimir Putin last week signed a decree that seizes full control of the Sakhalin-2 gas and oil project in Russia's far east…

IEA: World Must Triple Renewable Energy Spending by 2030 to Curb Climate Change

Investment in renewable energy needs to triple by the end of the decade if the world hopes to effectively fight climate change and keep volatile energy markets under control, the International Energy Agency (IEA) said on Wednesday."The world is not investing enough to meet its future energy needs ... transition‐related spending is gradually picking up, but remains far short of what is required to meet rising demand for energy services in a sustainable way," the IEA said."Clear signals and direction from policymakers are essential. If the road ahead is paved only with good intentions…

Oil Profits Soar: Oil Majors Shed Pandemic Blues

Europe's major energy companies profited from a rise in oil prices to report big increases in first-quarter earnings on Thursday, putting the worst of the pandemic era slump in fuel demand behind them.Last year's demand collapse forced BP, Royal Dutch Shell and Equinor to slash their dividends and preserve cash as they to try to transform themselves into companies that can thrive in a low-carbon world.With benchmark oil prices recovering from an April 2020 low of $16 a barrel to about $67 a barrel this month, most of the companies managed…

French EDF in Offshore Wind JV in China

French state-controlled power group EDF said on Tuesday it had agreed a joint venture partnership with China Energy Investment Corporation (CEI) to develop offshore wind farms in China.EDF will take a 37.5% stake in the project company through its subsidiaries EDF Renewables and EDF China. CEI Group will hold the remaining stakes through its Shenhua Renewable and Shenhua Clean Energy Holdings units.EDF said the offshore wind market in China was booming, with an expected installed capacity of over 40 GW by 2030 versus 6 GW of installed capacity at present.(Reporting by Sudip Kar-Gupta; editing by Jason Neely)

IEA: Global Energy Investment to Plunge 20%

Global energy investment is expected to plunge by around 20% or $400 billion in 2020, its biggest fall on record, because of the new coronavirus outbreak, the International Energy Agency (IEA) said on Wednesday.The Paris-based IEA said this could have serious repercussions for energy security and the transition to clean energy as the global economy recovers from the pandemic.Governments are easing restrictions put in place to curb the spread of the virus after the confinement of around 3 billion people brought the global economy to a near standstill.At the start of the year…

Schlumberger Posts Loss on $8.5 Bln Charge as Customers Accelerate Cuts

Schlumberger NV, the world's largest oilfield services firm, on Friday reported a first-quarter loss due to $8.5 billion in charges, as customers accelerated spending cuts amid the continuing decline in oil prices.Crude prices plunged 60% in March after Saudi Arabia and Russia vowed to pump full bore and the spread of the novel coronavirus crushed global fuel demand. On Friday, international Brent crude futures were trading around $28 a barrel, well below the cost of production for many big producers.The decline has caused big customers such as Exxon Mobil to cut spending at least 30% and halt some drilling.