UAE renewables firm Masdar weighs possible IPO, sources say

Three people familiar with the situation have confirmed that Masdar, Abu Dhabi's state owned renewables company, is considering a public offering. Two sources said that the company was considering a dual listing, one in New York and another in Abu Dhabi, to raise funds for renewable projects. A third person confirmed that Masdar had held informal discussions with banks. Two people have said that an IPO will not happen before 2026. One person said that the company might not even pursue an IPO. The three refused to give their names as the issue is not public.

ADNOC signs LNG supply contract with Japan's Osaka Gas

Abu Dhabi National Oil Company announced on Thursday that it had signed an agreement for 15 years to supply Japan’s Osaka Gas liquefied gas from the Ruwais Project. The agreement to supply LNG up to 0.8 mtpa is the fourth contract signed for the Ruwais LNG Project, where energy giants Shell, BP TotalEnergies, and Japan's Mitsui all have a 10% share. ADNOC stated in a press release that the LNG will primarily come from the Ruwais LNG Project, which is due to be completed in 2028.

Venture Global rises after brokerages begin coverage with bullish rating

Venture Global shares reached a weekly peak on February 18th, after several brokerages began coverage of the company with bullish ratings despite its dull market debut in January. Venture Global shares rose 5.8% to $16.87. On January 24, the liquefied gas (LNG), provider started trading at New York Stock Exchange for $24.05 per stock, valuing the company as the largest gas exporter. Its market capitalization is $58.2 Billion. Investors and analysts are concerned about the company's long-term profits and legal disputes with UK energy giants BP and Shell.

President Mozambique says that the country is not interested in reviewing terms of LNG projects.

Mozambique's new president stated on Friday that it is not interested in reviewing contract terms with energy giants such as TotalEnergies or ExxonMobil, who plan multi-billion dollar liquefied gas projects for the country. Daniel Chapo, the leader of the long-ruling Frelimo Party, took office on Tuesday after months of protests by opposition groups against his disputed electoral victory. Civil society groups claim that more than 300 people were killed.

Year Ender: Big Oil retreats from renewables as climate agenda falters

In 2024, major European energy companies increased their focus on oil and natural gas to maximize profits in the short-term. They also slowed down and sometimes reversed climate commitments. This is a trend that will likely continue in 2025. Oil majors have retreated after governments worldwide slowed down the rollout and set back targets for clean energy as energy prices soared in the wake of Russia's invasion of Ukraine. The share performance of the big European energy companies…

Sechin, Rosneft's boss, says that targets and costs are a hindrance to the appeal of green energy.

Igor Sechin is a well-known sceptic of green energy and the boss of Russia's largest oil producer Rosneft. He believes that investors are losing interest in clean energy because of elusive targets, high cost and lack of funding. Russia, the world's largest producer of oil, natural gas and coal, as well as China, have set targets to achieve carbon neutrality in 2060. This is 10 years later than other developed countries. The Russian president Vladimir Putin criticised the green movements in Europe for exploiting people's fears over climate change.

UAE's Masdar eyes Iberian renewables champion after recent deals

Masdar, the renewable energy company of the United Arab Emirates, will continue to grow its presence on the Iberian Market after signing two deals there in recent months. Masdar has signed its second major renewables deal with Spain in the last two months. It bought Saeta Yield, a Canadian company owned by Brookfield, for $1.4 billion. In July, the company agreed to purchase a small minority stake in an Italian Enel unit called Endesa that controls a 2 gigawatt solar portfolio. We're on the right track to creating our own champion.

Spain increases green hydrogen goal

Spain has raised its target for green hydrogen production capacity as a sign that it is confident in the industry, which has seen many energy giants cut back their plans due to high prices and an uncertain demand. According to a document released by the Energy Ministry on Monday, an updated version of the government’s strategy has set a target for 2030 of 12 gigawatts of electrolysers that are used to produce green hydrogen. This is up from 11 GW, which was in a previous draft of a new update last year.

Vattenfall, Swedish energy giants and other industry leaders join forces to invest in new energy sources

The companies announced on Tuesday that Sweden's largest utility Vattenfall will explore joint investments in new fossil free power production to meet the growing electricity demand as part of decarbonisation efforts. Vattenfall, along with Industrikraft, a group that includes Alfa Laval Boliden SKF Stora Enso, Boliden and the Volvo Group, is investigating how, when, and what investments they can make together. Borg stated that the annual Swedish power demand will double by 2045 from 140-150 Terawatt Hours (TWh)…

PipeChina to Buy $56B Worth of Pipelines

China took a major step in the reform of its national oil and gas pipeline network, with newly formed PipeChina agreeing to buy pipelines and storage facilities valued at 391.4 billion yuan ($55.9 billion).Under the deal, PipeChina, known formally as China Oil and Gas Pipeline Network, will take over oil and gas pipelines and storage facilities from state-owned energy giants PetroChina and Sinopec, in return for cash and equity in the pipeline company.The creation of PipeChina is aimed at providing neutral access to the country's pipeline infrastructure…

China Opens Up to Foreign E&P Firms

For the first time, China will this year allow foreign companies to explore for and produce oil and gas in the country, opening up the industry to firms other than state-run energy giants, as Beijing looks to boost domestic energy supplies.The long-awaited opening accompanies a reshuffle of the so-called "midstream" pipeline business, but experts say it may not excite immediate interest from global drillers because of the poor overall asset quality of China's hydrocarbon resources.From May 1, foreign firms registered in China with net assets of 300 million yu

Oil Majors to Raise $27Bln in Selling Spree

Global giants of the oil and gas industry – the so-called supermajors – are looking to sell assets that could fetch a total of $27.5 billion, according to Rystad Energy’s latest assessment.These companies are actively shedding mature assets on a massive scale in a bid to finance higher-yielding investments elsewhere, with the added benefit of pleasing shareholders who are calling for stricter capital discipline.“The expected transactions mean some of the majors are poised to exit certain regions…

CNOOC Earnings on the Rise

China's national offshore producer CNOOC Ltd reported a near 19% rise in first-half profit on Thursday, as higher sales of oil and gas offset weaker global oil prices.The listed arm of state-owned China National Offshore Oil Corp said that it was able to manage the impact on its business of the China-U.S. trade war and CNOOC President Xu Keqiang said the company would boost oil output to offset currency effects amid the escalating trade tensions.CNOOC said its net profit totalled 30.25 billion yuan ($4.26 billion) for the six months through June.

Cyprus Offshore Gas Discovery: Conflict or Hope?

Oil giant ExxonMobil, together with partner Qatar Petroleum (QP), made giant gas discovery to the east Mediterranean region after finding a gas-bearing reservoir offshore Cyprus and estimated in-place gas resources in the reservoir at 5 to 8 trillion cubic feet (tcf) of gas.The gas discovery off the coast of Cyprus could either bring tensions between the Mediterranean island and Turkey to the boil or help resolve the 45-year dispute between them, British newspaper the Guardian said.At present…

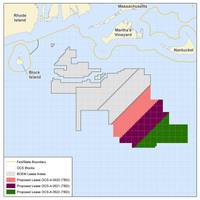

Europeans Sweep Record US Offshore Wind Auction

A U.S. government auction for three wind leases off the coast of Massachusetts ended on Friday with record-setting bids totaling more than $400 million from European energy giants including Royal Dutch Shell Plc and Equinor ASA.The Bureau of Ocean Energy Management (BOEM) announced the sale's three winners - Equinor Wind US LLC, Mayflower Wind Energy LLC, and Vineyard Wind LLC, at the conclusion of the two-day sale that attracted 11 bidders and lasted 32 rounds.Mayflower is a joint venture owned by Shell and EDP Renewables, a division of Portugal's EDP.

Oil Majors Spending 'Sweet Spot' to Last to 2020

Big Oil is today in a spending sweet spot as years of cost cuts and rising oil prices converge but investments will need to rise after 2020 to boost output, BlackRock, the world's largest asset manager, said on Tuesday.Oil and gas giants such as Royal Dutch Shell, Chevron and BP are generating as much cash at today's oil prices of around $70 a barrel as they did in 2014, before crude spiraled down from over $100 a barrel to lows of below $30 a barrel.As they emerge from the deepest downturn in decades…

Saudi Aramco, ADNOC to Cooperate on LNG

The state-owned energy giants of Saudi Arabia and the United Arab Emirates, Saudi Aramco and Abu Dhabi National Oil Company (ADNOC), signed a cooperation deal to explore potential areas for mutual collaboration in the LNG value chain aimed at bolstering gas production and revenue.The Saudi Arabian national petroleum and natural gas company based in Dhahran said in a press release that it has signed a framework agreement with ADNOC to explore opportunities…

Next-wave LNG Race Hits Hurdles in US-China Trade War

The delay of a U.S. Gulf Coast liquefied natural gas (LNG) export project has crystallized fears that the U.S. trade battle with China is hampering efforts to line up buyers needed to move ahead with multi-billion-dollar builds.The United States is positioning itself as the dominant provider of the supercooled fuel as Asian nations shift away from dirtier power sources like coal, and this month's approval of a giant Canadian project led by Royal Dutch Shell bolstered enthusiasm for the sector overall in North America.That optimism took a hit on Monday…

Bangladesh Shelves LNG Projects as Others Ramp Up

Bangladesh has put aside two smaller liquefied natural gas (LNG) projects with trading houses Gunvor and Vitol to focus on two larger LNG import terminals, one of which is already in use while the second will start up in March.Bangladesh has turned to LNG to offset falling domestic gas output to feed industrial demand and electricity generation in a nation of 160 million people where a third have no power supply.It aims to import 17 million tonnes a year of LNG by 2025, which in today's terms would make it a top five importer.

UK Regulator Probes SSE, Npower Merger

British regulators have launched an in-depth investigation into the tie-up between the retail power unit of SSE Plc and Npower, owned by Germany's Innogy, saying it may reduce competition and increase prices for some households.The merger would create Britain's second-largest retail power provider and reduce the "Big Six" dominating the market to five companies when they are already facing political scrutiny for their tariffs and pressure from smaller rivals.It also comes as German energy giants RWE and E.ON plan to carve up Innogy.