Palm production increases, causing a fourth consecutive session of declines

Malaysian palm futures dropped for the fourth session in a row on Thursday, closing at their lowest level since October 1. This was due to expectations that production would increase. However, strong competition oils prevented further losses. At the close, the benchmark palm oil contract on Bursa Malaysia's Derivatives exchange was down 3 ringgit or 0.07% to 4,012 Ringgit ($910.78) per metric ton.

Sinopec will prioritise risk management in its Russian oil purchases.

Sinopec Corp, the top Chinese refinery, will prioritize "risk management" when purchasing Russian oil. The quality of Russian oil is comparable to that of competing global supplies and its price is similar, according to a senior executive. These remarks follow a recent decision by China's oil importers, including Sinopec, who have resisted buying Russian oil this month while companies assess compliance after recent U.S. Sanctions on Moscow.

Sinopec's net profit for 2024 plunges 16.8% because of falling oil prices

China Petroleum & Chemical Corp, also known as Sinopec reported a 16.8% drop in net profit for 2024 on Sunday. The company cited lower crude oil prices, and the accelerated growth of the new energy vehicles (NEV) sector. This decline in net income is comparable to a drop of 9.9%, which also occurred in 2023 due to falling oil prices. Diesel sales dropped 4.8% and gasoline fell 0.7%. Aviation fuel sales rose 7.3%. Both domestic and export sales were included in the figures.

IEA: Russia's oil export revenue fell in February

The International Energy Agency reported on Thursday that Russia's revenue from crude oil sales and oil products fell by 2.6% in February compared to the same period last year, to $15.88billion. This was due to the fall in crude oil price and the widening of discounts for Russian grades. The report also stated that Russian oil exports fell by 100,000 barrels a day (bpd), compared to January, following a recent round U.S. sanction.

Hess reports a quarterly profit increase as Guyana's oil production remains strong

Hess Corp, a leading oil producer in Guyana, beat expectations for the third quarter profit on Wednesday. The Guyana assets have been at the heart of a dispute between Exxon and Chevron that has delayed Chevron’s $53 billion purchase of Hess. Hess agreed on the buyout in October last year, but Exxon has challenged the deal. They claim a right over the company's Guyana-based assets.

US fuelmakers report lower profits in Q3 due to weaker margins and fuel demand

Energy analysts predict that the third quarter profits of U.S. refiners will be lower than last year due to a decline in margins, as fuel demand has slowed and more refining capacity is coming online. After the pandemic, and Russia's invasion in Ukraine, which boosted margins at record levels, refiners are now reversing their favorable pricing and high demand. The difference between the product price and the crude oil price for U.S.

Palm oil prices rise on speculation and short-covering

Malaysian palm futures were up on Monday due to a combination speculative purchases and short covering. However, gains were limited by the lower crude oil price. By midday, the benchmark palm oil contract on Bursa Derivatives Exchange for December delivery rose 22 ringgit or 0.51% to 4,372 Ringgit ($1,018.88). The contract gained 2.76 % in the previous session. Paramalingam Supramaniam is the director of Selangor brokerage Pelindung Bestari.

Palm reverses losses due to higher crude oil prices

Malaysian palm futures recovered from early losses and ended higher for the second session in a row on Monday, due to higher crude oil price. The benchmark palm-oil contract for December delivery at the Bursa Derivatives exchange ended the session with a gain of 1.05%, ending the day at 4,345 Ringgit ($1,015.66) per metric ton. Earlier in the morning it had fallen as low as 4,247 Ringgit. The contract gained 3.87% in the last two sessions.

Energy prices are falling, putting pressure on big oil's huge payouts

Analysts said that major energy companies will borrow billions of dollars to maintain payouts to shareholders or reduce the rate of share purchases in response to a decline in oil prices following more than two years' bumper profits. Since decades, the majors have attracted investors with their promises of steady payouts. However, the shift to low-carbon energy has cast doubt on the long-term prospects of the industry.

Morgan Stanley lowers Brent crude oil price forecast as market signals softening demand

Morgan Stanley cut its Brent crude forecasts for the coming quarters on Monday and said that the global oil market was facing a period similar to recessions when demand is weak. Brent crude futures reached their lowest level since December 2021 at $71,06 on Friday. Brent crude was trading at around $71.74 per barrel by 1026 GMT. Morgan Stanley stated that the rising fuel inventories and lower refining margins…

Repsol Increases Low-carbon Targets to Accelerate Energy Transition

Spain's Repsol has hiked its 2030 capacity target for renewable energy generation by 60% and made a new pledge on cutting emissions from its oil and gas business, in the latest attempt by an energy group to limit its role in climate change.Facing pressure from investors, banks and governments to cut carbon emissions in line with the 2015 Paris accords, European oil and gas companies…

China Crude Processing Spikes to All-time High

Chinese refinery crude oil throughput has reached its highest level ever, with total processed volumes up 12% in the first five months of this year compared to 2020, and up 10.9% from the same period in 2019. In total 292.7m tonnes have been processed so far this year according to the National Bureau of Statistics China.Despite the 12.0% growth in crude oil processing, Chinese crude oil supply…

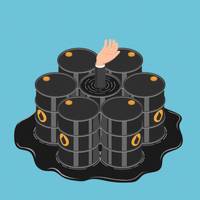

OPINION: Drowning in Oil, Regulatory Measures to Keep Prices Afloat

These days history seems to be in the making on a daily basis. On April 20, 2020, the price of the NYMEX West Texas Intermediate Sweet Crude Oil (WTI) futures contract for May delivery plunged into the negative, forcing sellers to actually pay customers for taking the crude oil off the sellers’ hands. The historic drop came a little over a month after Russia and Saudi Arabia initiated crude oil price war…

Shell Eyes Dividend Boost After 2020

Royal Dutch Shell on Tuesday said it expects to increase its dividend payouts to shareholders once it completes a $25 billion share buyback by the end of 2020.The world's second largest oil and gas company also expects its free cash flow - cash available to pay for dividends and share buybacks - to rise to around $35 billion per year by 2025 at a Brent crude oil price of $60 per barrel.That compares with $28-33 billion in free cashflow it expects to deliver by the end of next

BP to Invest $1.8 bln in Egypt

BP Chief Executive Bob Dudley on Monday said the company will invest about $1.8 billion in Egypt this year and he expects a crude oil price of $50-65 a barrel over the next year.Dudley added that the current oil price is healthy and fair and that the market feels balanced.(Reuters, Reporting by Nadine Awadalla and Aidan Lewis; Writing by Eric Knecht and Yousef Saba; Editing by David Goodman)

U.S. Crude Oil Stockpiles Dip, Gasoline Builds - EIA

U.S. crude oil stockpiles last week fell less than expected, while gasoline inventories increased and distillates stocks fell, the Energy Information Administration said on Wednesday.Crude inventories fell by 1.2 million barrels in the week to Dec. 7, compared with analysts' expectations for a decrease of 3 million barrels.The crude drawdown was also short of an over 10 million-barrel…

Now you see it, now you don't: oil surplus vanishes ahead of Iran deadline

An overhang of homeless crude in the Atlantic Basin has halved in recent weeks, suggesting oil traders are bracing for a further supply loss from Iran due to U.S. sanctions and a new rally in prices.Iran's oil exports are already dropping fast as refiners scurry to find alternatives ahead of a reimposition of U.S. sanctions in early November, which in turn has helped drain a glut of unsold oil.The millions of unsold barrels of crude that had pooled around northwest Europe…

Morgan Stanley Raises Brent Forecast

Morgan Stanley has raised its Brent crude oil price forecasts saying strong demand for middle distillates will drive up oil prices over the next two years. Oil benchmarks on Wednesday remained close to their November 2014 highs hit on Tuesday, as ongoing production cuts by OPEC and the prospect of U.S. sanctions against Iran tightened the market amid strong demand. Morgan Stanley said demand for middle distillates…

Oil Dips on Trump's Latest China Trade Talk

Trump threatens tariffs on $100 bln more of China trade. Oil prices fell on Friday after U.S. President Donald Trump's threat of new tariffs on China reignited fears of a trade war between the world's two biggest economies. Trump said on Thursday he had ordered U.S. trade officials to consider tariffs on an extra $100 billion of imports from China, escalating tensions with Beijing. "There is a risk for oil prices that China uses the bazooka option it has on U.S.

Shell Bets on Petrol Stations as Electric Revolution Looms

Shell to build 10,000 new petrol stations by 2025 with China, India and Mexico as primary growth targets. Royal Dutch Shell is placing a big bet on petrol stations and convenience stores in China, India and Mexico as it looks to shore up profits during the electric car revolution. By 2025, the oil and gas giant plans to grow its global network of roadside stations by nearly a quarter to 55,000, targeting 40 million daily customers, Shell said in a statement on Wednesday.