Russell: What is not happening in Middle East crude oil supply matters more.

It can be useful to consider what isn't happening in the Middle East when tensions are rising. On the crude oil markets, this means that we should focus on the fact there has not been a single barrel lost. All parties are interested in this situation. Crude oil prices increased again during early Asian trade on Monday. Brent futures, the global benchmark, gained 2.1% and traded at $75.76 per barrel. Brent crude oil rose to its highest level in almost five months on June 13 after Israel launched drone and air attacks that resulted in the deaths of several Iranian nuclear scientists…

Top five contrarian commodity scenarios for 2025: Russell

In 2025 it may be worth being a contrarian, since the year ahead could be one of most volatile ever, especially in commodities. Donald Trump is back, threatening to disrupt the global trade flow with a wall on imports. He will be able to do little this time, with a Republican-led Congress. China is the second largest economy in the world and the biggest buyer of commodities. The future of global energy transition is much more uncertain because of Trump's climate scepticism and the growing influence of right-wing parties in Europe.

Top five contrarian commodity scenarios for 2025: Russell

In 2025 it may be worth being a contrarian, since the year ahead could be one of most volatile ever, especially in commodities. Donald Trump is back, threatening to disrupt the global trade flow with a wall on imports. He will be able to do little this time, with a Republican-led Congress. China is the second largest economy in the world and the biggest buyer of commodities. The future of global energy transition is much more uncertain because of Trump's climate change doubt, the growing influence…

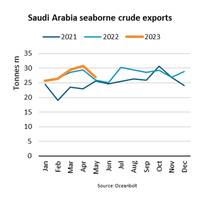

Saudi Arabian Crude Oil Exports Fall 12%

“By agreeing to an additional voluntary production cut within OPEC (Organization of the Petroleum Exporting Countries) of 500,000 barrels per day in May and announcing a further independent production cut of 1,000,000 barrels per day in July, Saudi Arabia is aiming to reduce excess supply and support prices,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.According to the EIA (U.S. Energy Information Administration), Saudi Arabian oil production fell to 9.9 mbpd (million barrels per day) in May…

TechnipFMC Shelves Spin-off Due to Market Turmoil

Franco-American oil services firm TechnipFMC Plc is putting on hold plans to split itself into two due to turbulence in financial markets linked to the coronavirus outbreak, it said on Sunday.The group, created three years ago via the merger of Technip and FMC, had been planning to separate its engineering and construction activities from its upstream oil services business in the first half of this year."Market conditions have changed materially due to the COVID-19 pandemic, the sharp decline in commodity prices, and the heightened volatility in global equity markets," TechnipFMC said in a statement."The impacts

Oil Down 2%

* Concerns of U.S. * U.S. Oil fell by more than 2 percent on Monday, pressured by a rise in Russian production, expectations that Saudi Arabia will cut prices of the crude it sends to Asia and a deepening trade spat between China and the United States. Brent crude was down $1.44, or 2.1 percent, at $67.90 a barrel by 1:32 p.m. EDT (1832 GMT). That was the lowest level since March 21. U.S. crude lost $1.72, or 2.7 percent, to $63.22, its lowest since March 20. Trading volumes were lower than normal as some countries were on Easter holiday.

Oil Falls to $69 as Earlier Rally Fizzles

Oil fell to around $69 a barrel on Monday, reversing an earlier rally, as a rise in Russian production and concern about a U.S.-China trade spat offset a drop in U.S. drilling activity. U.S. drillers cut seven oil rigs in the week to March 29, bringing the total down to 797, the first decline in three weeks. The rig count is closely watched as an indicator of future U.S. oil output. Brent crude, the international benchmark, fell 56 cents to $68.78 a barrel by 1358 GMT, having rallied to $70.04 earlier. U.S. crude slipped 75 cents to $64.19. "Investors took their cue from falling U.S.

Oil Inches Nearer to $70 on Lower U.S. drilling, Iran Worries

U.S. drillers cut rigs for first time in three weeks; concerns of U.S. sanctions against Iran also support crude. Oil rose towards $70 a barrel on Monday, lifted by a drop in drilling activity in the United States and concerns that Washington could reintroduce sanctions against Iran. U.S. drillers cut seven oil rigs in the week to March 29, bringing the total down to 797, the first decline in three weeks. The rig count is closely watched as an indicator of future U.S. oil output. Brent crude, the international benchmark, rose 58 cents to $69.92 a barrel at 0850 GMT.

Energy Battle is More Than OPEC vs U.S. Shale

The market narrative consuming crude oil markets currently is the interplay between supply cuts by OPEC and its allies and rising U.S. shale output, with a side helping of Chinese imports driving demand. While there are solid reasons for industry participants to focus on these dynamics, there is also the risk of missing out on other factors that help shape the market. Such a factor is India, which has long flown below the radar of the crude oil market, despite becoming the second-biggest importer in the fast-growing Asian market behind China, and the third-biggest in the world after the United States.

IEA Sees Oil Markets Tightening as PDVSA Output Sags

As U.S. oil output is poised to overtake Saudi Arabia, Venezuelan oil output is at 30-year low - and could fall further. Global oil markets are tightening quickly on falling supply from Venezuela, which posted 2017's biggest unplanned output fall and could see a further decline in 2018, the International Energy Agency (IEA) said on Friday. Debt and infrastructure problems cut Venezuela's December output to 1.61 million barrels per day (bpd), somewhere near a 30-year low. That helped oil prices top $70 per barrel in early January, their highest level in three years.

U.S. Crude Exports to Asia Complicate OPEC Strategy

U.S. crude oil is flooding into Asia, and may continue to do so as the arbitrage window that was initially created by Hurricane Harvey remains open, even though the disruption from the costliest storm to hit the Gulf of Mexico has faded. A record amount of U.S. crude is scheduled to arrive in Asia in November, according to vessel-tracking and port data compiled by Thomson Reuters Oil Research and Forecasts. The data show 19.7 million barrels of U.S. oil is due to arrive across Asia in November, equivalent to about 657,000 barrels per day (bpd).

Oil Markets Creep Higher on OPEC Pact Hopes

Strong demand and OPEC-led supply cuts support market. Crude oil markets were slightly higher on Friday, supported by continuing supply cuts and expectations that an output deal will be extended at the end of the month. Brent crude was at $64.22 a barrel at 1017 GMT, up 27 cents from the previous close and 43 cents off a more than two-year high of $64.65 reached this week. U.S. West Texas Intermediate (WTI) crude was at $57.26, up 9 cents and also not far from this week's peak of $57.92, its highest in more than two years.

China's Crude Splurge is OPEC's Best Friend

China's crude oil imports surged to the second-highest on record in September, but this isn't a sign of supercharged demand in the world's second-biggest economy. It's rather a shuffling of where oil is being stored around the globe and a couple of factors that caused a temporary boost to Chinese import demand. China's crude imports jumped to 37 million tonnes in September, equivalent to 9 million barrels per day (bpd), according to preliminary customs data released on Oct. 13. This was up from August's 8 million bpd, but it's worth noting that August was an eight-month low.

China's Crude Oil Buying Spree Set to Continue

China has built its crude oil stockpiles at a record pace in 2017 and while its purchases could tail off towards the year-end, inventories could hit the billion-barrel mark in six months, the International Energy Agency said. China has spent around $24 billion on building its crude reserves since 2015, at an average of $50 a barrel, and now holds around 850 million barrels of oil in inventory. While China's spending on "excess" crude is tiny, given its $680 billion current account surplus since early 2015, its inventories are now equal to those of Japan and South Korea together, the Paris-based IEA said.

Crude Oil Markets Bullish, But Not Really: Russell

Sentiment is often a somewhat flighty and nebulous concept, but it appears that crude oil markets are turning increasingly bullish about the prospect for higher prices. Certainly the mood at this week's major industry conference in Singapore was a marked change from recent years, with several upbeat presentations, panel discussions and off-the-record chats giving the view that prices were more likely to rise than fall. The most bullish commentary at the Asia Pacific Petroleum Conference (APPEC) was from trading house Trafigura…

Harvey Hurts Crude Rebalancing, Also Creates 'Opportunity'

Crude oil's flirtation with backwardation has been hit by the market dislocations caused by Hurricane Harvey, the massive storm that is disrupting the U.S. crude oil import, export and refining hubs along the Gulf of Mexico coast. Two weeks ago the Brent crude futures curve was backwardated, with the front-month contract commanding a premium over the following four months. But by the close on Wednesday, the global benchmark oil was once again mainly in contango, with the front-month at $50.86 a barrel, a discount of 27 cents a barrel to the six-month future.

Volatility Ahead for U.S. Crude, Investor Bets Split

Market open interest in WTI climbs to highest since Sept 2013. U.S. crude oil is set for a volatile path ahead as both bullish and bearish wagers soar to record levels, with even large Wall Street banks at odds over future trends. Total long positions have risen to the highest level in over a year, while short positions climbed to a fresh record high, data from the U.S. Commodity Futures Trading Commission (CFTC) on Friday showed. "It does set you up for a bit of a push-pull situation between the bulls and the bears," said Michael Tran, director of energy strategy at RBC Capital Markets in New York.

Oil Steady Ahead of U.S. Stocks Data; Libya Limits Loss

Oil prices were steady on Tuesday as forecasts for a ninth straight weekly drop in U.S. crude stockpiles offset a rallying dollar and a global fuel glut. A protest over wages that shut the eastern Libyan oil terminal of Hariga and forced a suspension of 100,000 barrels per day of crude production also helped the market limit losses, traders said. Brent crude futures were up 6 cents at $47.02 a barrel by 11:00 a.m. EDT (1500 GMT), after trading as high as $47.49 earlier. U.S. crude's West Texas Intermediate (WTI) futures slid by 24 cents to $45 a barrel after a session high at $45.67.

Oil Steady near $47 as Oversupply Concerns Weigh

Saudi Arabia moving out of its peak seasonal demand; U.S. shale output to fall to 4.55 mln bpd in August. Oil prices steadied near $47 a barrel on Tuesday as concerns over a glut of crude and refined fuel outweighed an expected cut in U.S. shale production and a probable further drawdown in U.S. crude inventories. Crude prices fell more than 1 percent in the previous session after worries about potential supply disruptions stemming from an attempted coup in Turkey proved unfounded. "We are about…

Saudis Ending Oil Market War: Russell

Has Saudi Arabia already switched tack and started to surreptitiously balance supply and demand in the crude oil market? One of the persistent themes of crude oil markets since the price crashed in mid-2014 is that top exporter Saudi Arabia decided to stop its balancing role and instead chase market share, no matter the implication for prices. However, there are signs that the pursuit of market share by the kingdom is no longer a top priority, especially in their buyers in Asia. Figures from top Asian crude buyers China…