Nigeria’s Refining Revolution is Reshaping West Africa’s Energy Landscape

The launch of the Dangote Refinery near the Port of Lagos presents an exciting opportunity to transform the energy and shipping markets in West Africa. And it stands to boost Nigeria’s role as an influential player in the global oil industry, fostering economic growth and regional…

Exports of crude oil by Mexico's Pemex rose 33% from January to February

The crude oil exports of the Mexican state energy company Pemex increased 33% from January to February, recovering from the drop in the previous month but still being down 25% when compared with February 2024. Pemex published data late Tuesday showing that crude exports reached 709,793 barrels a day (bpd) in February.

Commodities ignore Trump's noise and focus on fundamentals of trade: Russell

The best way to navigate the challenges that the U.S. president Donald Trump's inconsistent and erratic trade policies are posing for the global commodity markets is to ignore the noise and concentrate on the fundamentals. While the media focuses on every headline-grabbing announcement…

Russell: China's commodity imports will continue to decline until 2025 due to economic and trade concerns

China's imports have been weak in 2025. This is in line with the recent trend of a softer economy. According to data released by the official customs on Friday, imports of crude, natural gas and iron ore, as well as copper, have all decreased in the first half of this year when compared to the same period of last year.

Russell: China's commodity imports will continue to decline until 2025 due to economic and trade concerns

China's imports have been weak in 2025. This is in line with the recent trend of a softer economy. According to data released by the official customs on Friday, imports of crude, natural gas and iron ore, as well as copper, have all decreased in the first half of this year when compared to the same period of last year.

Canada mentions potash and oil as a possible lever to use in the tariff dispute

Melanie Joly, Canada's Foreign Minister, told Toronto businesspeople on Wednesday that Canada may use its oil and gas exports to negotiate if U.S. import tariffs increase. Canada has announced that it will impose tariffs worth C$155 billion on U.S. imports, but so far has not indicated…

After financial disputes, talks to resume Kurdish crude oil exports have been postponed until Thursday

Three sources said that the talks to accelerate a return of oil exports out of Iraq's semiautonomous Kurdistan Region have been postponed until Thursday due to disagreements between oil companies, and the oil ministry. Three sources said that the meeting was originally scheduled for Tuesday…

Exports of crude oil by Mexico's Pemex fell 44% in January

Official numbers reveal that crude oil exports from the Mexican state energy company Pemex fell 44% in January, compared to last year, to 532 404 barrels per daily (bpd), their lowest level in decades. The company admits it has been struggling with crude's quality. The level for January…

Trump calls for OPEC price reductions

The oil prices dropped more than 1% Monday, after U.S. president Trump asked OPEC for a price reduction following his announcement of sweeping measures to increase U.S. gas and oil production in his first weeks in office. Brent crude futures fell 87 cents or 1.11% to $77.63 per barrel at 0043 GMT, after closing up 21 cents Friday. U.S.

What impact Trump's tariffs on commodities and energy might have

President-elect Donald Trump on Monday pledged tariffs on the United States' three largest trading partners - Canada, Mexico and China - detailing how he will implement campaign promises that could trigger trade wars. Canada exported some $177.19 billion in energy products to the United States in 2023, according to government data.

Commodities fall amid increased risks of Trump's second-term: Russell

Commodities have reacted to Donald Trump's election to a second U.S. term with fear, and most are losing ground due to fears that a new trade war will hit the global economy. The negative reaction contrasted sharply with the record-breaking performance of U.S. stocks, which rose to new highs amid optimism about Trump's tax cut agenda…

VEGOILS - Palm falls, Chicago soyoil losses and profit-taking

Malaysian palm futures declined on Thursday as investors booked profit and the Chicago soyoil contracts weakness added to the decline. At midday, the benchmark palm oil contract on Bursa Derivatives Exchange for December delivery fell 38 ringgit or 0.91% to 4,158 Ringgit ($987.18) per metric ton.

Gunvor chair: Mideast conflict will not affect oil supply but demand is a concern

The CEO of trading firm Gunvor is confident that the conflict in the Middle East won't impact oil supply. He said this on Tuesday. He told the Gulf Intelligence Energy Markets Forum, held in Fujairah that the situation in the Red Sea and Yemen was a nuisance but not disruptive. The market, he said, was more concerned about the weak demand.

After historic oil vote, little progress in Ecuador's Amazon

In the Amazon, on August 20, 2023, almost 60% of the population voted to keep crude oil in the ground. Environmentalists and Indigenous Communities hailed the referendum as a historic victory for protecting one of the most biodiverse areas of the planet and a rare instance of the shift away from fossil fuel based economies.

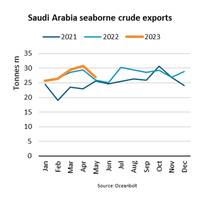

Saudi Arabian Crude Oil Exports Fall 12%

“By agreeing to an additional voluntary production cut within OPEC (Organization of the Petroleum Exporting Countries) of 500,000 barrels per day in May and announcing a further independent production cut of 1,000,000 barrels per day in July, Saudi Arabia is aiming to reduce excess supply and support prices…

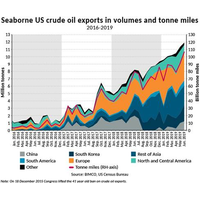

U.S. Crude Oil Exports: When 'Less is More'

Longer sailing distances cushion fall in US crude oil exportsTon mile demand generated by US crude oil exports has fallen by 9.7% in the first two months of 2021 compared with the start of 2020. The fall could however have been much worse; In volume terms, seaborne crude oil exports have fallen by 18.8%…

What Does US-China Trade Deal Mean for Oil Markets?

After over a year of trade tensions, the US and China signed a “phase one” trade deal on 16 January. As part of the deal, China has agreed to increase the value of energy imports by $52.4 billion above 2017 levels over the next two years. What could it mean for the oil market?Ann-Louise Hittle…

US Crude Exports Expected to Double by 2022

The U.S. could see its crude oil exports nearly double by 2022, according to energy research firm Rystad Energy. US crude exports could grow from current levels of 2.9 million barrels per day (bpd) to nearly 6 million bpd by 2022.With US production expected to increase by 1.2 million bpd year-over-year (y/y) in 2020…

BIMCO: US Crude Exports Soar in June 2019

The highest US crude oil exports to China in 11 months lifted total seaborne US crude oil exports to a record high at 11.9 million (m) tonnes in June 2019. Also contributing to the June record was South Korea, as exports to the other main Far Eastern buyer reached an all-time high…

U.S. Crude Exports Reach a Record of 3.16 mln bpd

U.S. crude oil exports surged 260,000 barrels per day (bpd) in June to a monthly record of 3.16 million bpd as South Korea bought record volumes and China resumed purchases, data from the U.S. Census Bureau showed on Friday.South Korea surpassed Canada to become the biggest purchaser of U.S. crude at about 605,000 bpd.