Shell Appoints New Head of Refining

Royal Dutch Shell has appointed Huibert Vigeveno to head its downstream businesss, the refining operations that are to become a key pillar for the oil and gas company as it transitions to cleaner energy.Vigeveno, 50, previously led Shell's global commercial business and rose to prominence when he oversaw the integration of smaller rival BG Group after its $53 billion acquisition in 2016.His appointment comes several months after Wael Sawan replaced Andy Brown as head of the oil and gas production, or upstream, division.Both…

Shell: Nigeria Tax Claim May Delay Offshore Field

Shell upstream boss Brown sees 'no merit' in tax claim. Separately, Shell to fast track Whale development in Gulf of Mexico.Royal Dutch Shell said on Tuesday that Nigeria's claims that it was owed billions in taxes could delay the development of a major oil field off the coast of the West African nation.Nigeria ordered several major foreign oil and gas companies to pay nearly $20 billion in taxes it says are owed to local states, industry and government sources told Reuters.Shell, the largest investor in the West African nation…

Shell Appoints Sawan as Upstream Boss

Royal Dutch Shell has appointed Wael Sawan to head its oil and gas production division, replacing Andy Brown who will step down after 35 years at the Anglo-Dutch company.Sawan, 44, a Canadian citizen of Lebanese origin, currently heads Shell's deepwater operations, one of the company's cash growth engines in recent years. He joined Shell in 1997.Brown, 56, will remain a member of Shell's executive committee until his departure on Sept.

OKEA Gets Approval to Acquire Shell's Draugen, Gjoa Fields

Norway's Ministry of Petroleum and Energy and Ministry of Finance has approved the transaction from AS Norske Shell and OKEA concerning the transfer of the licenses associated with the Draugen field in the Norwegian Sea and the Gjøa field in the North Sea.The Trondheim-based oil company informed in a press release that the Ministry of Petroleum has also approved OKEA as new operator for the Draugen field.AS Norske Shell and OKEA AS aims to close the transaction on November 30, it said.Norwegian producer backed by private…

Shell Adds New FPSO in Brazil

New, deep-water production is underway today at the Lula Extreme South in the Brazilian Santos Basin. Royal Dutch Shell plc, through its subsidiary Shell Brasil Petróleo Ltda. (Shell) and consortium partners, announces that the FPSO P-69 is now producing.Operated by Petrobras, P-69 is a standardized vessel that can process up to 150,000 barrels of oil and 6 million cubic meters of natural gas daily. It will ramp up production through eight producing and seven injection wells."The Brazilian pre-salt fields are some of the best deep-water provinces in the world," said Andy Brown, Upstream Director for Shell.

Shell Sells its Danish Upstream Assets for $1.9 Bln

Royal Dutch Shell has agreed to sell its Danish upstream business to Norwegian Energy (Noreco) in a deal valuing the assets at $1.9 billion, as part of its wider divestment strategy, the company said on Wednesday.The sale brings Shell's three-year $30 billion divestment plan close to its conclusion, having begun the process in 2015 after the acquisition of BG Group. Deals so far have included large portfolios in the British North Sea, Gabon, Thailand and Canada."Today's announcement is consistent with Shell's strategy to…

Shell Starts New Gulf of Mexico Field ahead of Plan

Royal Dutch Shell on Thursday announced the start of production at the Kaikias field in the U.S. Gulf of Mexico, around one year ahead of schedule.Production from the subsea deep water development, which will reach 40,000 barrels of oil equivalent per day, comes after Shell reduced its costs by around 30 percent to allow it to generate profit at less than $30 a barrel, the company said."We believe Kaikias is the most competitive subsea development in the Gulf of Mexico and a prime example of the deep-water opportunities we're able to advance with our technical expertise and capital discipline…

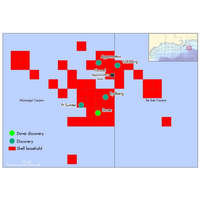

Shell Makes Large Heartland Discovery in GoM

Shell Offshore, Inc. (“Shell”) has announced a large, deep-water, exploration discovery in the Norphlet geologic play in the U.S. Gulf of Mexico with its Dover well (100% Shell). The Dover discovery is Shell’s sixth in the Norphlet and encountered more than 800 net feet of pay (244 meters). The discovery is located approximately 13 miles from the Appomattox host and is considered an attractive potential tieback. Shell’s Appomattox host has now arrived on location in the U.S. Gulf of Mexico and is expected to start production before the end of 2019.

How Shell Hid a Whale Before Placing Mexican Oil Bet

Announcement of Whale well discovery delayed until auction. The gasps in the audience were clearly audible at the auction of Mexico's oil blocks a month ago as Royal Dutch Shell's hefty bids were announced one by one. The size of Shell's cash payments - $343 million out of the total of $525 million that Mexico earned in the sale - far outstripped its competitors' offers, guaranteeing that the company swept up nine of the 19 offshore blocks. The Anglo-Dutch major knew something no one else did. Six months earlier, its drilling rig had struck a giant oil reservoir, the Whale well, in the U.S.

Shell Announces Plan for Penguins Filed Redevelopment

Shell announced the final investment decision for the Penguins field redevelopment project in the U.K. sector, which includes the construction of a new-build Sevan Marine designed cylindrical floating production, storage and offloading (FPSO) vessel. The Penguins field is in 165 metres of water, approximately 150 miles north east of the Shetland Islands. Discovered in 1974, the field was first developed in 2002 and is a joint venture between Shell (50 percent and operator) and ExxonMobil (50 percent). The Penguins field currently processes oil and gas using four existing drill centres tied back to the Brent Charlie platform.

Shell OKs First UK North Sea Project in Six Years

Shell approves Penguins expansion; project projected to generate profit even at sub-$40 oil prices. Royal Dutch Shell gave the green light on Monday for an expansion of the Penguins oil and gas field in the UK North Sea, its first major new project in the ageing basin in six years. Shell said the development, which includes the construction of a floating production, storage and offloading (FPSO) vessel, reaffirmed the Anglo-Dutch company's commitment to the region after it sold around half of its assets there last year.

Qatargas to Supply LNG to Shell

Qatargas and Shell have signed a memorandum of understanding (MOU) that will lead to the two companies jointly researching liquefied natural gas (LNG) logistics. Through this joint logistics research collaboration, Qatargas and Shell aim to develop new ways to optimize supply chains to deliver to LNG global markets. The research will be conducted at the Qatar Shell Research & Technology Centre at the Qatar Science & Technology Park. The MOU was signed by Faisal Al Suwaidi, Chairman and Chief Executive Officer of Qatargas Operating Company, and Andy Brown, Managing Director of Pearl GTL and Qatar Shell Country Chairman.

Shell to Sell Some North Sea Assets to Chrysaor

Shell has agreed to sell a package of UK North Sea assets to Chrysaor for a total of up to $3.8bn, including an initial consideration of $3.0bn and a payment of up to $600m between 2018-2021 subject to commodity price, with potential further payments of up to $180m for future discoveries. The package of assets consists of Shell’s interests in Buzzard, Beryl, Bressay, Elgin-Franklin, J-Block, the Greater Armada cluster, Everest, Lomond and Erskine, plus a 10% stake in Schiehallion. Based on the initial consideration received…

Shell Starts Oil Production from Malikai Deep-water Platform in Malaysia

Shell has started oil production from the Malikai Tension-Leg Platform (TLP), located 100-kilometers off the coast of the Malaysian state of Sabah. Located in waters up to 500-meters deep, Malikai is Shell’s second deep-water project in Malaysia, following the successful start-up of the Gumusut-Kakap platform in 2014. Malikai is expected to have a peak production of 60,000 barrels per day. As the company’s first TLP in the country, Malikai is an example of the strength of Shell’s global deep-water business, applying TLP expertise from decades of operations in the U.S. Gulf of Mexico.

Shell Divests Non-core Shale Acreage in Western Canada

Royal Dutch Shell plc, through its affiliate Shell Canada Energy (“Shell”) has announced it has agreed to sell approximately 206,000 net acres of non-core oil and gas properties in Western Canada to Tourmaline Oil Corp. for a total consideration of approximately $1,037 million (C$1,369 million). The consideration is comprised of $758 million in cash and Tourmaline shares valued at $279 million. Subject to regulatory approvals the transaction is expected to close in the fourth quarter of 2016. The acreage includes 61,000 net acres in the Gundy area of Northeast British Columbia…

Shell Shedding $500 mln in Assets

Royal Dutch Shell is currently offering 16 assets each worth more than $500 million for sale as part of its vast $30 billion three-year asset sales programme, the oil and gas company's head of upstream Andy Brown said on Wednesday. The Anglo-Dutch company launched the programme to reduce its debt following the acquisition of BG Group earlier this year. Uncertainty over the future oil price has led to a sharp slowdown in deal making in the sector in recent years. "There are 16 assets currently in the market that are above $500 million in value," Brown told the Oil and Money conference in London. Reporting by Ron Bousso

Shell Organizational Changes in N. America

Royal Dutch Shell announced that after a 34-year career with the company, Unconventional Resources Director and U.S. Country Chair, Marvin Odum, will leave Shell at the end of March, 2016. Concurrent with Marvin’s departure, and in a move that will simplify Shell’s structure, the Athabasca Oil Sands Project and the Scotford Upgrader in Canada will join the global Downstream organization under Downstream Director, John Abbott; and the Shale Resources business will join the global Upstream organization under Upstream Director, Andy Brown. As a result of these changes, The Unconventional Resources Directorate will cease to exist.

Shell: "Substantial" Gabon Gas Find

Shell has announced a frontier exploration discovery offshore Gabon, West Africa. The well Leopard-1 encountered a substantial gas column with around 200 metres net gas pay in a pre-salt reservoir. Leopard-1 is located around 145 kilometres off the Gabonese coast, west of Gamba. It was drilled in water 2,110 metres deep to a total vertical depth of 5,063 metres. Shell and partners are planning to undertake an appraisal programme to further determine the resource volumes. “Shell has been exploring in Gabon for over 50 years.

Shell Finds Gas in New Site Offshore Malaysia

Anglo-Dutch oil and gas major Shell announced on Thursday it had found gas in a new drilling area off Malaysia. It found more than 450 metres of gas column at its Rosmari-1 well and plans further exploration, Shell said. "Rosmari-1 is a testament to our ability to successfully drill and build understanding of new geology within our existing exploration heartlands, adding value to our existing assets in Malaysia," said Andy Brown, director of Shell's international upstream business. The well is located near Block SK318, in which Shell has an 85 percent stake. Malaysia's Petronas Carigali owns the remaining 15 percent.