Equinor, Norway's largest oil company, scales back its climate ambitions due to wind change

Equinor, the Norwegian energy company, has weakened its plan for energy transition as it struggles with delivering on promises to invest in renewable energy technologies and low-carbon technology. It cited practical difficulties and shifts in political priorities. In 2022, the oil and gas producer laid out short and medium term steps to achieve net zero emission, including those from using its products, by 2050. In February…

EU May Need 350 additional LNG Cargoes

Helge Haugane, head of Equinor's gas and power trading, told Bloomberg News that the European Union could need up to 350 additional cargoes this year of liquefied gas (LNG).Haugane stated that in the worst case scenario, European reserves of gas could only be 30% full at the end winter. He added that it will be crucial to attract cargoes over the summer for the storage to be refilled, and this could be expensive and require…

Bloomberg News reports that Equinor believes EU may require 350 additional LNG cargoes in order to replenish reserves.

Helge Haugane, head of Equinor's gas and power trading, told Bloomberg News that the European Union could need up to 350 additional cargoes this year of liquefied gas (LNG). Haugane stated that in the worst case scenario, European reserves of gas could only be 30% full at the end winter. He added that it will be crucial to attract cargoes over the summer for the storage to be refilled, and this could be expensive and require regulatory interventions. Equinor didn't immediately respond to our request for a comment.

Equinor expects a decrease in storages and a rise in gas prices next year.

The CEO of Norwegian oil-and-gas producer Equinor stated on Thursday that European gas prices continue to be under pressure because of the rising demand for gas in Asia, and due to concerns about future supplies of Russian gas and LNG. The weather and temperature will determine the demand for European products. "A normal or cold winter would put upward pressure on the prices," CEO Anders Opedal said to reporters after the company announced its third quarter earnings.

Equinor Q3 profit drops 13%, lagging forecast

Equinor reported a sharper-than-expected 13% decline in third-quarter profit on Thursday, hit by weaker oil prices and lower production, and cut its full-year outlook for capital expenditure and renewable energy production growth. Equinor's poll of 25 analysts found that the adjusted earnings for the period July-September fell from $7.93 to $6.89. This is below the $7.08 billion estimated by Equinor. The organic capital expenditure for 2024 has been revised down to between $12 billion and 13 billion dollars…

Norway's Equinor cancels plans to export Blue Hydrogen to Germany

A spokesperson for Equinor, the Norwegian energy company, said that it had scrapped plans to ship so-called "blue hydrogen" to Germany due to its high cost and insufficient demand. In January 2022, Equinor signed an agreement with Germany's RWE to create a hydrogen supply network for German power plants in order to reduce greenhouse gas emissions. Plans include producing blue hydrogen (hydrogen from natural gas combined with carbon capture and storing) in Norway…

Norway's Equinor cancels plans to export Blue Hydrogen to Germany

A spokesperson for Equinor, the Norwegian energy company, said that it has scrapped plans to export blue hydrogen into Germany due to its high cost and insufficient demand. In January 2022 Equinor signed a Memorandum of Understanding with Germany's RWE to create a hydrogen supply network for German power plants in order to reduce emissions. Plans included producing blue hydrogen (hydrogen from natural gas combined with CCS) in Norway…

Equinor will invest up to $6,7 billion a year until 2035 in oil and natural gas offshore Norway

Equinor said it plans to invest 60-70 billion Norwegian crowns (US$5.7-$6.7 billion), a year, in oil and natural gas offshore Norway through 2035. It expects a continued strong demand for fossil fuels. Norway is Europe's biggest gas supplier, and it's a major oil producer. It pumps around four million barrels equivalent to oil per day. However, many of its offshore fields are declining, and no new developments are planned for the 2030s.

Soaring Gas Prices Power Equinor Q2 Profits

Equinor said it will return an additional $3 billion to shareholders after reporting better-than-expected second-quarter profit on the back of soaring gas prices fuelled by the war in Ukraine. The company boosted gas supplies to Europe by 18% in the April-June period compared to a year ago, making Norway the continent's largest supplier of piped natural gas as Russia cut deliveries amid a standoff with the West over the war."Equinor has become Europe's most important supplier of energy during this conflict…

Equinor's Incoming CEO Wants to Be Best in Offshore Oil, Gas

Anders Opedal, who on Monday was named Equinor's new chief executive, said he wanted the Norwegian oil company to be both best in offshore oil and gas and at the same time have higher climate targets and develop new low-carbon solutions."I want Equinor to be best in offshore oil and gas," Opedal told a news conference at the company's headquarters, adding that he also wanted the company to create a platform for growth for low-carbon solutions."I want to go further ...

Opedal Tapped for Top Spot at Equinor

The Equinor Board of Directors appointed Anders Opedal as its new president and CEO starting November 2, 2020. Eldar Sætre will retire after six years as CEO and more than 40 years in the company.Opedal ascends to the top spot coming from the position as Executive Vice President Technology, Projects and Drilling. He joined Equinor as a petroleum engineer in 1997, spent many years in Drilling and Well and served as Chief Procurement Officer.

Equinor's $466M Floating Wind Farm Plan Approved

Norway approved on Wednesday Equinor's 4.8 billion Norwegian crowns ($466 million) plan to build floating offshore wind turbines that will provide electricity to North Sea oil and gas platforms, the energy ministry said.The long-planned project is going ahead despite Equinor's decision to cut investment following a plunge in oil prices that has reduced the company's cash flow.Five platforms at Norway's Snorre and Gullfaks fields will be the first in the world to receive power from a floating wind park…

Cost Estimates at Equinor Norway Fields Goes Up

The cost of developing two major Norwegian oil and gas fields has increased due to the complexity of the projects, with the start of production delayed for one of them.The Ministry of Petroleum and Energy reports on the status of major projects that are currently undergoing development or have recently started operation.Thirteen of Equinor’s projects are on this list. Eight of the projects have reduced costs since submitting their plans for development and operation…

Johan Sverdrup Phase 2 Plan Approved

Norwegian authorities have formally approved the plan for development and operation (PDO) of the second phase of the Johan Sverdrup field, Equinor announced on Wednesday. The Norwegian energy company said the NOK 41 billion ($4.7 billion) project received broad support in Norway’s parliament at the end of April, and today the partnership received the formal approval by the Norwegian Ministry of Petroleum and Energy (MPE).“This is a big day for Equinor and the other Johan Sverdrup partners comprising Lundin Norway…

Johan Castberg Topside Construction Begins

Norwegian minister of petroleum and energy Kjell-Børge Freiberg cut the first sheet for the topside of the Johan Castberg floating production, storage and offloading unit (FPSO) at Kværner's yard at Stord on Wednesday as part of a large scale project triggering ripple effects throughout Norway.The topside will be installed on the 200-meter long FPSO vessel that will be producing on the Johan-Castberg field for 30 years…

Unmanned Platform Starts Production at Oseberg Vestflanken 2

The Oseberg Vestflanken 2 field in the North Sea came on stream on Sunday. Remote-operated from the Oseberg field center, the new Oseberg H platform is the first unmanned platform on the Norwegian Continental Shelf. Recoverable resources are 110 million barrels.“With Oseberg H we take a huge technological leap forward. The fully automatic, unmanned and remote-operated platform is digitalization in practice, and I am proud of Equinor and its partners having chosen this in-house developed solution…

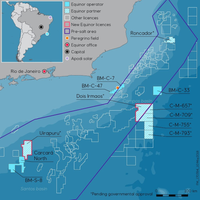

Brazil Becomes Core Ares for Equinor

With daily oil production of over 90 000 barrels per day from current fields and with expected investments of more than 15 billion USD until 2030, Brazil has become a core area for Equinor.A press release said that Brazil stands out globally as one of the most promising offshore oil and gas basins with a significant remaining resource base. In addition, the country has a huge potential within renewable energy.Brazil is a great fit with Equinor’s strategy…

In Brazil, Equinor Aims to Repeat Norway's Oil Boom

Norway's Equinor will invest up to $15 billion in Brazil over the next 12 years to develop oil, gas and renewable energy sources, the company said on Wednesday.Coinciding with an expected drop in output from many ageing oilfields off the cost of Norway, Brazil is expected to become a core region for Equinor as the firm takes advantage of the country's opening in recent years to more foreign investment.The company plans to raise its Brazilian output to between 300…

Equinor Buys 25% Stake in Brazil’s Roncador Oil Field

Equinor and Petrobras have completed their transaction announced in December 2017, whereby Equinor has acquired a 25 percent non-operated interest in the Roncador oil field in Brazil’s Campos Basin. This follows all transaction conditions being met, including government and regulator approval.Reflecting equity volumes produced since the effective date of January 1, 2018 and the deposit paid upon the signing of the transaction, Equinor has paid Petrobras an adjusted cash consideration of $2 billion.

Equinor Deepens Its Offshore Brazil Portfolio

Equinor has expanded its portfolio in Brazil’s prolific Campos and Santos basins after winning the Uirapuru and Dois Irmãos blocks in the 4th Production Sharing Bidding Round in Brazil.Equinor, ExxonMobil and Petrogal Brasil presented the winning bid (75.49% profit oil) for the Uirapuru production sharing contract in the Santos basin. Petrobras exercised its right to enter the consortium and will be the operator with 30% equity.The final equity distribution is Petrobras (30% operator)…