U.S. Coal Falls Victim to Stagnating Electricity Demand

U.S. electricity consumption has remained flat for the last six years, the first such prolonged pause in growth, as recession and improvements in efficiency have bitten deeply into demand.

Homes, schools, offices and factories consumed a total of 3,831 billion kilowatt-hours of electricity in 2013, basically unchanged from the 3,816 billion in 2006, and well down from the record 3,890 billion in 2007, according to the Energy Information Administration (EIA) (Chart 1).

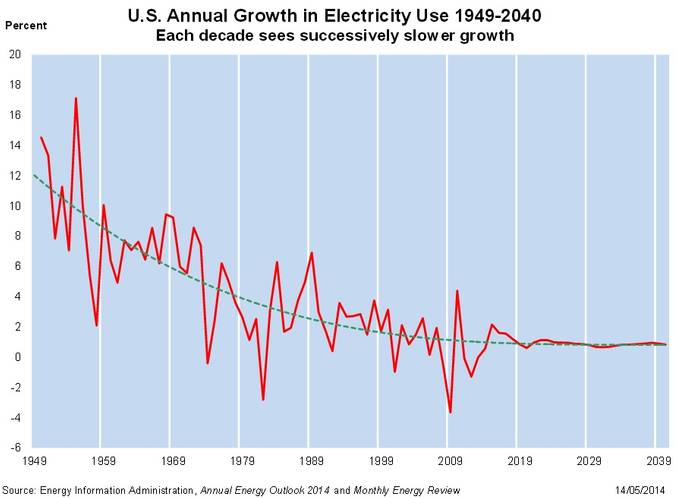

Consumption growth has slowed every decade since the 1950s as the rapid gains from electrification and the introduction of modern appliances and airconditioning have given way to a more mature industry (Chart 2).

Growth slowed from 9.9 percent per year in the 1950s and 7.4 percent in the 1960s to 4.7 percent in the 1970s, 2.9 percent in the 1980s and 2.4 percent in the 1990s. Consumption grew less than 0.7 percent in the 2000s and has slowed further over the last ten years to just 0.5 percent.

Recession cut use around 170 billion kilowatt-hours (4 percent) between 2007 and 2009. But even as the economy has recovered, consumption has remained flat.

Most of the reduction compared with the previous trend can be traced to federal and state energy efficiency standards for new buildings and appliances such as refrigerators and washing machines, as well as the transition away from incandescent light bulbs, which have made deep cuts in underlying demand.

"Although electricity demand fell in only three years between 1950 and 2007, it declined in four of the five years between 2008 and 2012," according to EIA.

The slowdown mirrors trends in other advanced industrial economies like the United Kingdom. Britain's consumption peaked in 2005 and has now fallen back to 1997 levels as a result of better home insulation and appliance efficiency coupled with behavioural changes stemming from higher electricity prices ("Digest of United Kingdom Energy Statistics" 2013).

EIA forecasts U.S. electricity consumption will start growing again, as a rising population and an increasing range of electronic devices, including electric vehicles, outweigh continued gains in efficiency.

The agency projects growth of under 1 percent a year until 2040, which would increase generation around 29 percent and require 351 gigawatts of new generating capacity to satisfy demand ("Implications of low electricity demand growth" in Annual Energy Outlook 2014).

But like all long-term projections, this one is surrounded by a substantial amount of uncertainty. The EIA's reference scenario is based on the efficiency standards that have already been enacted; it makes no allowance for new ones that could cut demand further.

The uptake of electric vehicles, which could be another major source of demand, remains difficult to forecast. EIA assumes plug-in and all-electric vehicles make up 2 percent of new cars and trucks sold by 2040.

But even if future demand remains highly uncertain, it seems likely that demand will grow much more slowly than in the past.

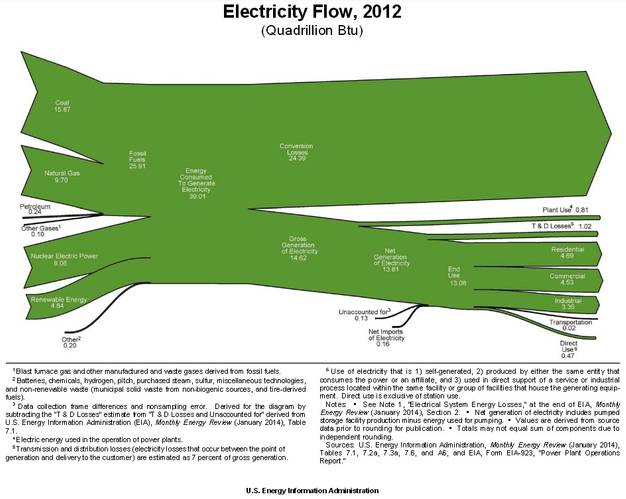

Efficiency gains are making a vital contribution to reducing greenhouse emissions because the electricity generation and distribution system is relatively wasteful.

Just one-third of the energy used to generate electricity is delivered to end users. In 2012, the electricity sector consumed 39 quadrillion British thermal units of energy but delivered only 13 quadrillion to customers (Chart 3).

Efficiency is also hastening the demise of older, smaller coal-fired power plants. Most were built before the 1980s and lack the scale to compete effectively with new gas-fired power plants using cheap shale gas.

Moreover, environmental regulations require them to retrofit expensive scrubbers to clean up their mercury emissions.

In a growing market, some of these coal-fired units might survive, but with electricity demand essentially flat, they cannot hope to compete with cheaper and cleaner gas, as well as subsidies and mandates for renewables, and generate the returns needed to justify installing expensive new scrubbers.

U.S. power producers plan to retire 191 coal-fired generators between 2014 and 2017 with a combined capacity of 27,300 megawatts. Coal-fired units account for more than half the planned capacity shutdowns over the next four years, according to EIA. Only 7 new coal-fired plants will be opened.

Coal's supporters blame tough new emissions regulations established by the federal government for the shutdowns, but in reality coal plants never stood much chance in a world of cheap gas, renewables mandates and stagnant electricity demand.

(By John Kemp, Editing by William Hardy)